The project I am going to review today very much resembles Basic Attention Token ICO. Why? OmiseGo is also going to be built on the existing product, Omise. It is a very popular payment management platform in Southeast Asia, especially in Thailand. And let’s check out what they want to do with the blockchain technology and why they need initial coin offering.

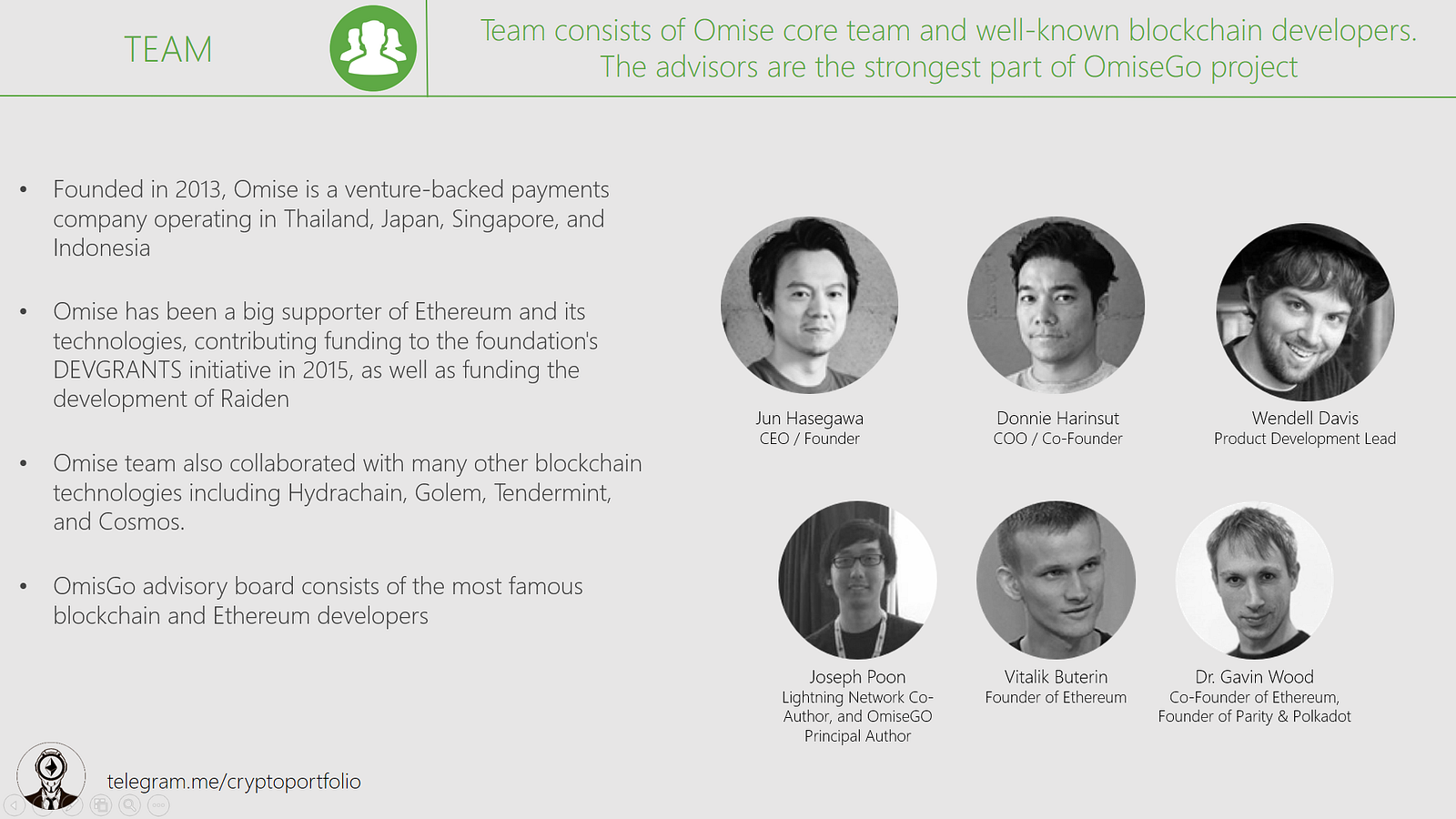

Team consists of Omise core team and well-known blockchain developers. The advisors are the strongest part of OmiseGo project because they almost all are from Ethereum foundation.

Founded in 2013, Omise is a venture-backed payments company operating in Thailand, Japan, Singapore, and Indonesia.

Omise has been a big supporter of Ethereum and its technologies, contributing funding to the foundation’s DEVGRANTS initiative in 2015, as well as funding the development of Raiden.

Omise team also collaborated with many other blockchain technologies including Hydrachain, Golem, Tendermint, and Cosmos.

OmisGo advisory board consists of the most famous blockchain and Ethereum developers. Vitalik Buterin, Gavin Wood, lightning network creator Joseph Poon. Stars.

Basically, OmiseGo is an e-wallet and payment platform operating across currencies and assets.

OmiseGo will create a platform for managing fiat/cryptocurrency/other assets with its powerful wallet Software Development Kit. OmiseGo builds a liquid on-chain decentralized exchange and off-chain payment network to make its ecosystem work

OMG tokens will be native currency of the OmiseGo blockchain. OmiseGo is going to be a new blockchain.

With OmiseGo the users will be able to manage: fiat tokens, cryptocurrencies, other assets (such as loyalty and reward points).

Software Development Kit will be provided to ensure full interaction with OmiseGo network.

The OmiseGo blockchain will be closely integrated into Ethereum mainnet. You can get to know more from reading technical whitepaper.

The OmiseGo will solve a lot of problems, including settlement time, fees, transparency, security, finality.

OmiseGo wants to be the place where you do not need a bank account to cash in or cash out.

One of the biggest markets OmiseGo wants to cover is Remittances market.

Of course, OmiseGo wants to cover more markets , such as: payments, loyalty and rewards, gaming and messenger platforms.

As you can see, the biggest remittances destinations are in Southeast Asia. This is the market where Omise team is really concentrated.

In 2016 the remittances market was evaluated at $442 bln.

Having certain advantages like low fees, fast transaction time, easy cashouts and cashins can be a powerful argument for usage of OmiseGo e-wallet.

The profit generation comes from holding OMG tokens. They will be used to validate the Proof of Stake network of OmiseGo and that’s how tokenholders will get rewards.

More transactions on the OmiseGo blockchain = more rewards go to tokenholders.

I made assumption that OmiseGo collects all $19 mln. and compared this project with major payment companies. Some incredible gains possible if the project is a success.

Any on chain acitivity needs to pay fees for validating the network.

Simple value appreciation leads to investors’ portfolio value increase.

OmiseGo tokenholders must wait until the blockchain is created.

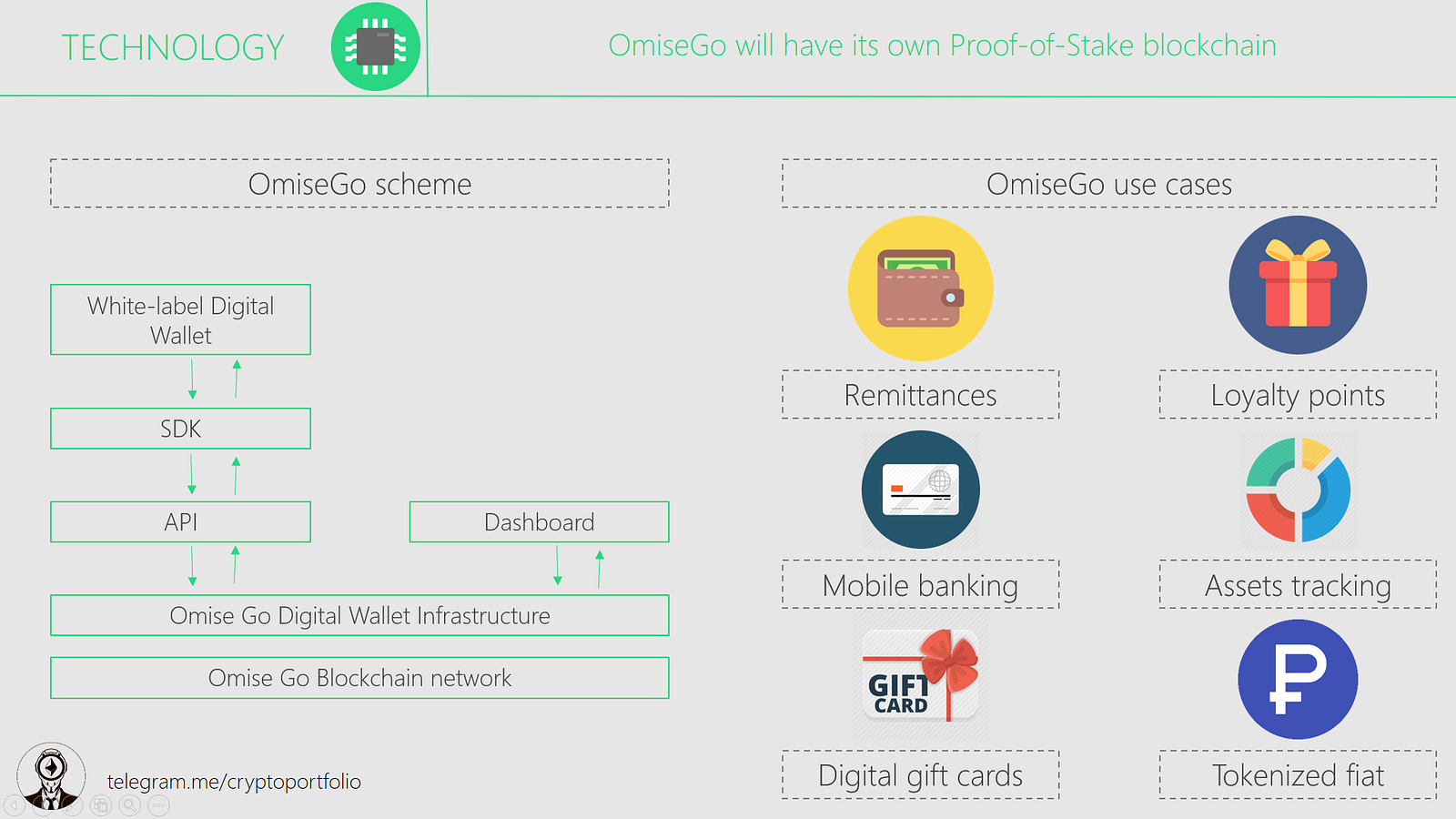

OmiseGo has its own Proof-of-Stake blockchain with validators and other important variables of POS networks.

Here is the scheme of the OmiseGo network. Everything is built to support Digital Wallet functionality.

The main use cases of OmiseGo:

1. Remittances

2. Loyalty points

3. Mobile banking

4. Asset tracking

5. Digital gift cards

6. Tokenized fiat

In my opinion, this project is one of the most solid ones and , at the same time, less demanding from investors than others.

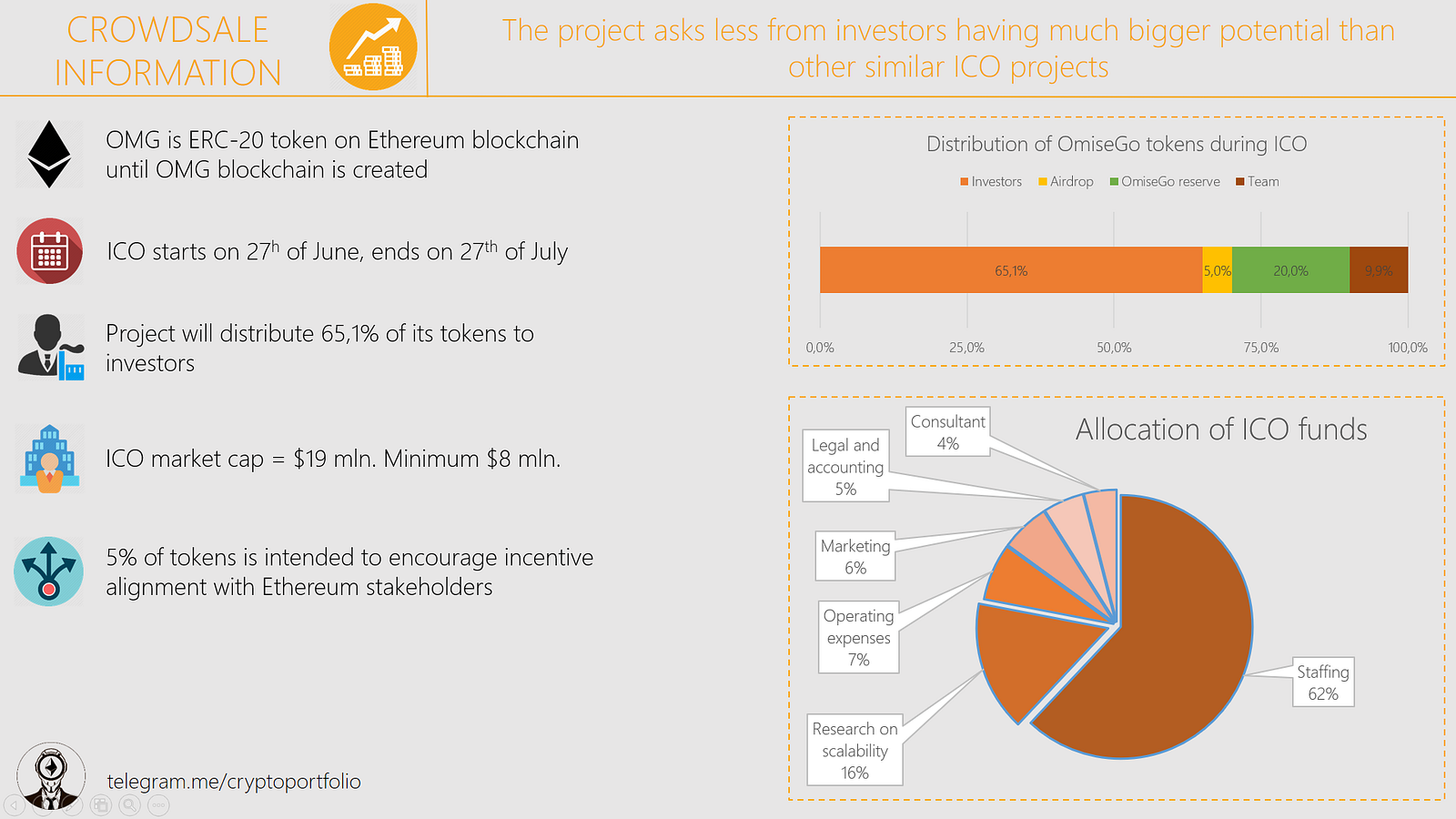

First of all, OMG is ERC-20 token on Ethereum until OMG blockchain is created. After the creation, the OMG tokens will be transferred to its own blockchain.

ICO starts on 27th of June and ends 1 month later. Seems to be without any time bonuses.

65,1% of all OMG tokens will be distributed to investors, 20% — reserve, and 9,9% — team.

Max cap is $19mln, minimum is $8mln.

5% of tokens is intended to encourage incentive alignment with Ethereum stakeholders.

Almost all the money goes to research and development. This is how allocation of of ICO funds is made: 62% — staffing, 16% — Scalability research, 7% — Operating expenses, 6% — marketing, 5% — legal, 4% — consultancy.

Advantages and disadvantages. First of all, I want to mention that I haven’t found a lot of disadvantages so you should tell your opinion about it in the comments.

Team is rock solid with existing selling product.

Advisory board consists of Ethereum and Bitcoin stars.

They have a clear vision of their product and the existing customer base which will use their product.

The biggest disadvantage for me is that they are building their own blockchain.

Another disadvantage is that they are now exclusively concentrated on Asia, I hope soon they will expand to Europe and America.

Reactie plaatsen

Reacties